By Mehtab Haider –

While foreign debt inflows have uplifted Pakistan’s economy, the picture of internal accounts is not rosy yet thanks to weak tax net

Although, Pakistan’s external account seems in comfortable position mainly because of debt creating dollar inflows during last two years rule of PML-N but internal accounts (fiscal position) remained fragile as Pakistani people were literally heading towards demonstrating tax revolt by not paying their due taxes into the national kitty.

Pakistan’s external front in terms of balance of payment has witnessed comfortable position now after two year rule of PML-N mainly because of generosity shown by the IMF and other multilateral and bilateral donors but also helped by reduced price of POL products in international market.

The current account deficit (CAD) has been on higher side in first half of the current fiscal in the wake of decline in exports and surge in imports but the borrowed dollars as well as increased remittances helped the government to improve its balance of payment position.

The country’s balance of payment (BoP) improved resulting into increasing foreign exchange reserves of over $16 billion, crossing a psychological barrier of $15 billion. This development has paved the way for resumption of World Bank’s IBRD loan of $2 billion for Pakistan. After successful completion of IMF’s reviews under $6.67 billion bailout package for Pakistan, the Asian Development Bank (ADB) will also provide program loans to the country during the remaining few months of the current fiscal year.

But the improvement in external account was achieved through borrowing. The country’s foreign currency reserves (both State Bank of Pakistan and commercial banks) had doubled in last two years reaching from $7 billion to over $15 billion but it was first fiscal year in the country’s history in which net foreign debt went up by $5 billion in single year.

But the improvement in external account was achieved through borrowing. The country’s foreign currency reserves (both State Bank of Pakistan and commercial banks) had doubled in last two years reaching from $7 billion to over $15 billion but it was first fiscal year in the country’s history in which net foreign debt went up by $5 billion in single year.

In first six months of 2014-15, the net external borrowing was estimated at $2.4 billion but the reserves increased by $1.5 billion hence $900 million were used to finance the deficit in BoP.

Pakistan’s exports declined by 5 percent in first half of the current fiscal year and now touching flat position in seventh and eight months despite getting GSP plus from European Union.

On imports, despite sharp decline in POL prices and commodities the imports increased in the current fiscal year so the trade deficit had widened.

The remittances have again rescued the country by showing over 15 percent growth and fetched $8.982 billion in first half of the current fiscal year.

On external front, the overall situation has showed improvement but increased dollar borrowings will increase risk on account of future external debt sustainability. The external debt had touched $65 billion and it will be increased over the medium term. The IMF has also asked Pakistan to adopt debt strategy in order to reduce the debt burden over the medium term.

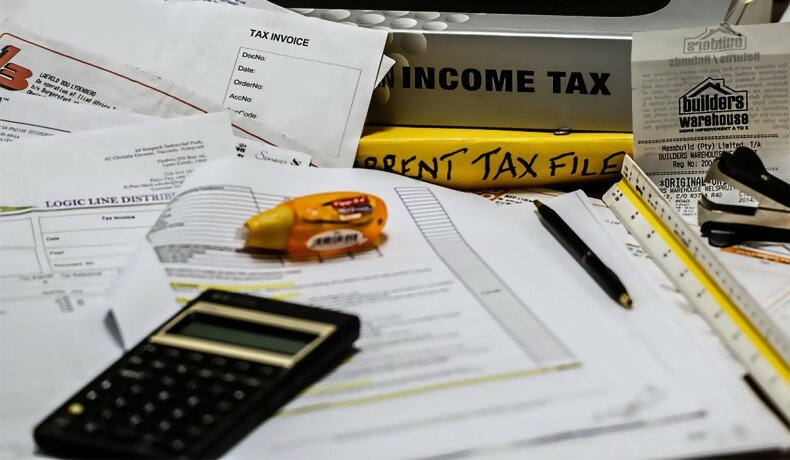

On internal accounts, it is consistently worst from last two to three decades. The country’s tax to GDP ratio was hovering around 8 to 9 percent during last two decades and it decreased from just over 10 percent to slightly above 8 percent in recent years mainly because of highly skewed tax base and all measures of tax machinery had failed to give dividends.

The narrowed tax base could be gauged from this fact that of total 180 million populations, only 0.8 million are return filers. Even on corporate sectors, out of total 64 thousands registered companies with the SECP, only ten thousands were return filers. It shows the dismal picture of both individual and corporate sector return filers.

On revenue collection side, alone in the ongoing fiscal year, the ruling party had taken tax measures of over Rs 380 billion in the budget 2014-15 and four mini budgets afterwards but the tax collection was showing dismal results.

On revenue collection side, alone in the ongoing fiscal year, the ruling party had taken tax measures of over Rs 380 billion in the budget 2014-15 and four mini budgets afterwards but the tax collection was showing dismal results.

The government had envisaged tax collection target of Rs 2810 billion on eve of this year’s budget which was already revised downward twice from Rs 2810 billion to Rs 2756 billion and now Rs 2691 billion in line with the agreement with the IMF.

This revised target of Rs 2691 billion is highly unlikely to be achieved as first of all it is linked with the stay order of superior court on Gas Infrastructure Development Cess (GIDC) as if it was vacated then the FBR will be able to collect Rs 31 billion in shape of taxes. Otherwise the tax collection will be standing at Rs 2660 billion on June 30, 2015.

Dr Hafiz A Pasha, former finance minister and renowned economist told Pique that the latest adjustment of GST on petroleum products was not tax neutral as the government would collect additional Rs 20 billion by enhancing GST rate from 27 percent to 37 percent on High Speed Diesel. Although, the government had reduced GST rate from 27 percent to 18 percent on petrol, kerosene and other petroleum products and raise GST rate from 27 to 37 percent on HSD with the claim that it was tax neutral and this adjustment was meant to keep POL prices unchanged for March 2015. But Dr Pasha says that this adjustment on HSD towards higher side would yield additional Rs 20 billion tax revenues for the government mainly because of higher consumption of HSD in the country.

Pakistan will have to broaden its tax base in consultation with the provinces in the aftermath of 18th Constitutional amendments. First of all the government will have to bring all kind of income into tax net irrespective of its source as agriculture income is exempted from the tax. The services sector will have to bring into the tax net.

On administrative side, the FBR will have to overcome rampant corruption from its file and ranks. The Tax Reform Commission (TRC) is working to come up solid recommendations but the government will have to demonstrate its political will to implement tough decisions on improving tax administration as well as bringing all sectors into tax net by removing all kinds of exemptions. There are hundreds of tax exemptions and in case of each exemptions, one power lobby is behind it so the government will have to show its muscle to bring them into tax net for the sake of the country.

Overall position of public finances is not in good shape on both tax and non tax revenues. On expenditures side, the security spending and subsidies will again go up and the government will be left with no other option but to slash down the development spending in order to curtail the budget deficit.

The government has maintained the budget deficit target within the desired limits of 2.4 percent of GDP in first half of the current fiscal by delaying certain liabilities on debt servicing but the overall budget deficit target of 4.9 percent of GDP would be breached by end June 2015. (Ends)

The writer is a senior economic correspondent based in Islamabad

The writer is a senior economic correspondent based in Islamabad