By Waqar Gillani –

Youth Loan Scheme comes with fears of failure amid economic slowdown and bad law and order situation

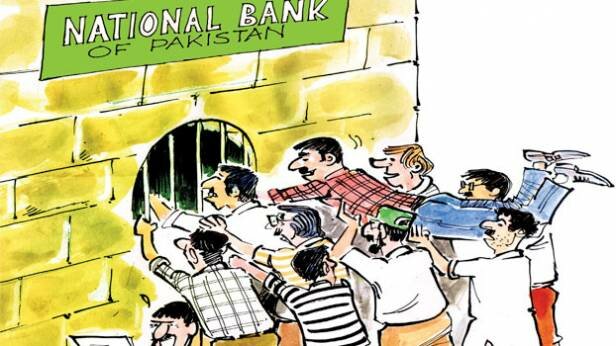

These days, dozens of youths can be seen queuing up outside the National Bank of Pakistan main branch in Gulberg, Lahore. They are not there to pay utility bills but to apply for the Prime Minister’s Small Business Loan Scheme in the hope of becoming self-employed and self-dependent.

Muhammad Afzal, 29, in the queue has a master’s degree in social sciences from the University of Punjab and is without a job for seven years now. “I have six siblings and our only support comes from a small general store which my father runs in a poor locality of Lahore. The loan scheme is a window of opportunity for me, says Afzal.

The PML-N government allocated Rs5 billion in the current fiscal year for the scheme. As many as 100,000 loans, worth Rs2 million would be given to people between the ages of 21 and 45 years. On one condition though, they have to have robust business plans.

The loans are being processed through the National Bank of Pakistan (NBP) and First Women Bank (FWB). There are plans of urging private banks to finance this scheme in future. Half of the 100,000 loans are reserved for women under the programme headed by Maryum Nawaz, politically aspirant daughter of the prime minister.

The loan scheme is the biggest in the first three quarters with the overall plan of awarding Rs100 billion to 100,000 unemployed youths to generate economic activity and promote small industries. The scheme is the first of the six schemes, including distribution of free laptops to students, fee reimbursement, skill development plans etc.

Subsidized finance would be given at eight per cent mark-up per annum with a tenure up to seven years and a debt: equity of 90:10 covering the whole of Pakistan including Gilgit-Baltistan, Azad Jammu & Kashmir and Federally Administered Tribal Areas (FATA).

Few days ago, the government informed the National Assembly that as many as three million had so far applied under the PM’s lone scheme till then. The share of each province would be fixed according to the population ratio under the National Finance Commission (NFC) formula.

Soon after the announcement, the scheme was hit by snags over the tough conditions that had to be met by the applicants in order to qualify for loan. One of the key challenges while processing this scheme was the issue of guarantees sought from the applicant against the loan.

The youth demanded to simplify the procedure. “Following this hue and cry some of the conditions have been done away with,” Moazzam Ali Khan, Press Relations Officer of the youth projects office said.

Now, any person including blood relatives and family member having net worth of 1.5 times of the loan‚ and any grade-15 or above government officer with eight or more years remaining services can be a guarantor; more than one person with cumulative net worth of more than 1.5 times the loan can give guarantees on single loan application; and anyone with net worth more than 1.5 times the loan can give his own guarantee.

The banks are receiving 4000 to 5000 applications daily. It is said that quota to the provinces under the NFC formula would be allocated very soon. After that male and female applications would be separated according to the province. It is believed that the first draw is a matter of days now. Applicants keep your fingers crossed.

Meanwhile, the government plans to give training to female loan seekers to improve their business skills. Small and Medium Enterprises Development Authority (SMEDA) has developed pre-feasibility studies in 15 sectors. As many as 55 business plans are available on its website.

One cannot avail the loan facility without a business plan. The bank is always reluctant to implement any scheme without the possibility of proper recovery.

Currently, the fatality rate in the Small and Medium Enterprises businesses, in normal conditions, is more than 35 per cent. The risk in such government’s politically targeted schemes could go above than 50 per cent, the official expresses. Around 54 per cent of Pakistan’s population is under 18 years of age and 60 per cent are under 30.

The demographic forecast suggests that in the next five years the number of people within the age bracket of 18 to 23 years will be around 30 million. Of these, only five million will have access to education whereas the remaining 25 million will be without education and skills required to get employment. Women entrepreneurs, as compared to men, are expected to face more difficulties in this business practice.

Experts believe self-employment and entrepreneurship are the only solutions to the economic woes of the jobless youth but there are risks as well. Dr Rashid Amjad, Economist and Director of Graduate Institute of Development Studies (GIDS), linked these plans to the efforts to eradicate unemployment – the biggest socio-economic problem of Pakistan. “Finding means of employment can have demographic dividend, which are required at the moment,” he said.

Sharing some of the fears and risks, one applicant says, “Firstly, I am not sure I will be getting the loan. Secondly, even if I get there is no guarantee that my business would be successful. In this situation, it will be a challenge to give the money back to the bank.”

A recent study by a political economist Dr S. Akbar Zaidi mentioned that the number of people in the age group 15-49 years and the total labour force are projected to nearly double by 2050, which needs a growth strategy that focuses on creating employment and have high employment elasticity.

Pakistan has introduced such schemes to cater unemployment since the 1980s, but have practically failed to create significant impact except getting political mileage. Where this scheme would end in future, is yet to be seen!

The writer is a journalist based in Lahore. The writer tweets @waqargillani