By Aqeel Akbar Chaudhry –

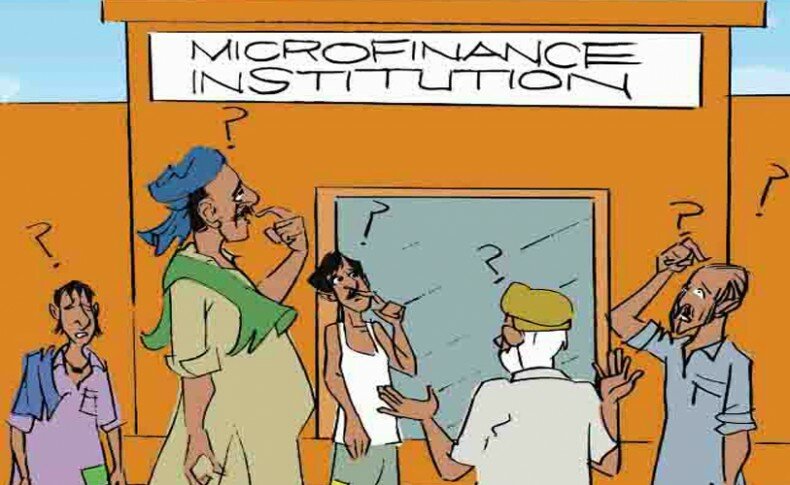

Microfinance is generally perceived to be a silver bullet to initiate innovative solutions towards ending poverty. Poverty is a complex problem, which is perpetuated by weak human capital, lack of opportunities for social mobility, and restricted access to resources, amongst many other factors.

Microfinance is supposed to provide the most deprived segment of the society with opportunities that they would not get under traditional institutional set ups, by dealing with some of these factors that perpetuate poverty. However, it is erroneous to assume that Microfinance would, on its own, tackle poverty and provide relief to a wider poor population. Microfinance is just one of many interventions that can help with the situation, though

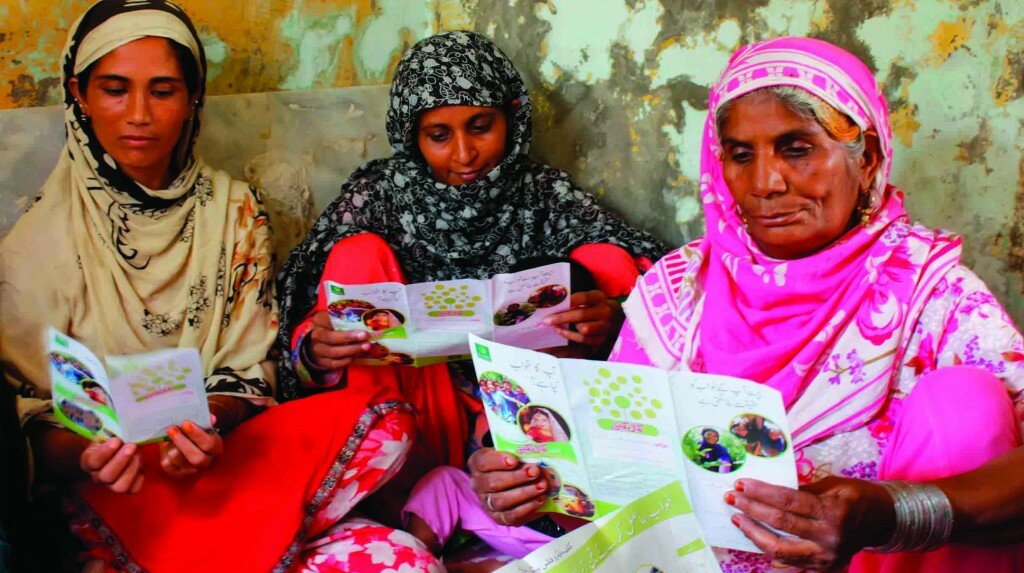

The concept of microfinance is very simple: individuals, who are not served by traditional banks because they don’t meet their basic criteria, can apply for small loans from a microfinance institution. These small loans are invested in income generating activities, and then the individual pays the loan back to the microfinance institution from that income. The revolutionary part about microfinance is how these small loans were collateralized. These individuals, who are exclusively poor, do not have any collateral to give to institutions in return for that loan. The innovative solution is introducing something known as “social collateral”.

The early practitioners noticed that the target market of poor and very poor individuals normally had a very strong sense of community. These communities of poor people normally lived in small congested quarters, and social interaction with each other was an essential part of being. Tapping that, these individuals were asked to form groups, of varying sizes, with other individuals in the same community, and one group of individuals were responsible for all the loans given to that group. Hence, if one person from the group defaulted or refused to pay back the loan, the whole group would be deemed a defaulter.

There were varying consequences of that, mainly the discontinuation of future credit. Hence, there was a social pressure to repay the loans. Individuals reneging on their pledges to repay the loans would face social ire, because their actions were impacting the businesses of their neighbors. There was additional benefit of self-policing, where the group would keep tabs on the utilization of these loans. If there were issues of mismanagement of the loan, the members of the group would feel obliged to intervene. This also saved manpower at these microfinance institutions. One can argue the morality of the method, but the bottom line is that it worked, more or less.

This concept provided financial support for many poor families that had no other means for capital accumulation. There were many success stories of micro-entrepreneurs, raising their profiles from nothing. The model was replicated in different parts of the world, with similar results. It even resulted in a Nobel Peace Prize for one of the prime innovators, Muhammad Yunus, of the Grameen Foundation in Bangladesh.

The model of microfinance was expanded to facilitate the concept of financial inclusion of the poor in the banking sector. Not only did microfinance institutions start providing training services for more successful micro-enterprises, through Business Development Services, but also made an effort to provide more financial services for these individuals. Saving products were introduced to encourage the poor to save and build up their capital. Insurance products were introduced to help them against fluctuations in the market conditions. Hence, over time, these microfinance institutions not only started providing multifaceted services to the people that were unbankable previously, but also were successful businesses in their own right. Enterprises with a social mission, if you may.

However, there were numerous pitfalls to this method as well. Microfinance lenders are often criticized for their high interest rates and collection methods. There are a lot of overhead costs associated with continuous engagement with the microfinance clients over the tenure of the loan. The initial engagement with potential clients is also a long and slow process, where they are explained how the process works. With average loan size being very small, these costs constitute a bigger portion of the total loan portfolio, as compared to a commercial bank. Hence, to be economically viable, these microfinance institutions have much higher interest rates. Interest rates for microfinance institutions can go up to 40% APR in Pakistan, for example.

These high interest rates, charged to very poor people who have no other viable option to pursue, is traditionally seen as predatory behavior. Microfinance institutions are, justifiably or unjustifiably, critiqued for exploiting the very poor. Another valid critique is the methods used for collecting the loans. Normally, the repayment rate is over 97%.

However, in exceptional circumstances such as natural disasters or market disruptions, the non-repayment shoots up. The social collateral which forms the basis of conformity becomes a hurdle, as everyone defaults on their loans. Microfinance institutions have been accused, in the past, for employing coercive tactics to recover their portfolio. In one instance, there were mass suicides in India by farmers after their crops failed, and their microfinance lenders exerting extraordinary pressure for the recovery of their loans. A lot of present consumer protection laws and programs were a result of these measures.

However, a more valid critique of microfinance sector should be its’ efficacy. Whereas, the success stories of many micro-entrepreneurs are highlighted by microfinance banks, one cannot gauge the overall effect of the intervention. For every successful micro-entrepreneur, there were many who didn’t make it. In fact, there isn’t a lot of evidence that shows that microfinance, on its own, can raise the fortunes for a whole community. There has also been a lax attitude of the microfinance practitioners to track the poverty levels amongst its clients over time, which can be helpful in determining the exact effect of these institutions on a community. However, there have been developments on that front now.

Even though microfinance can’t increase the profile for a whole community, what it does provide is access to opportunities which the more entrepreneurial individuals can benefit from. These microfinance institutions deal with factors that perpetuate poverty, by providing people with access to capital which might eventually have a positive effect on those individuals and their families.

Microfinance is only one of the many tools that can be employed in dealing with the multifaceted problem of poverty. It is best used as a part of a multi-pronged approach of dealing with the issue, which involves good planning and coordination between many public and private organizations. It is, however, erroneous to think of it as the sole savior of the poor.

The writer is an economist based in Islamabad.